Playing The System

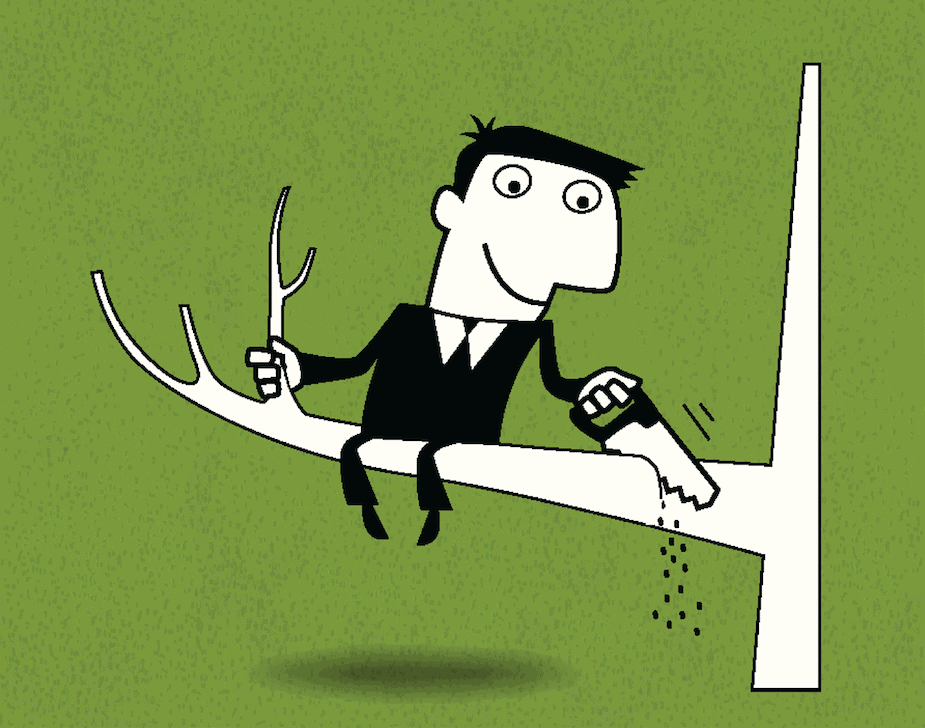

I held off writing this email for many weeks now. I dread sounding like a condescending, finger-wagging, fear monger. But when I witness the aggravation and damage that business owners bring upon themselves day-in-day-out, I feel that I must speak out. This must stop. Please forgive.

I am referring to what is known in the Credit Card Processing industry as “collusion”.

The purpose of a merchant account is to be able to accept credit card payments from customers – for the goods or services disclosed during the application process. A business owner may not charge a credit card to loan themselves money. Certainly not their own card!

Aside from bad economics (it costs 2% – 3% to get those funds = approximately 25% a year) … someone who swipes cards through their account for non-true-business purposes is putting their entire business at risk. The processors and card brands (especially Amex) are on high alert for such transactions and will detect these transactions most of the time. For a business that relies on being able to accept credit card payments, the fallout can be devastating. The merchant account will get shut down by the processor with the business and business owner getting blacklisted by all US processors. Many times the funds (that the merchant so badly needed) will get frozen for six months, leaving the business owner with a credit card bill to pay without even having the funds he tried to obtain.

We see these stories every day. A business who is accustomed to transactions ranging $500 – $1000, suddenly processes a $25,000 transaction. A quick review shows this was the merchants own card (or father, brother, neighbor, etc.) being swiped to cover payroll the next day. Please I ask all our clients (and please tell your friends too): don’t take risks. No loans on credit card. The processors and card brands are diligently scrutinizing every large transaction. (If you are in need of urgent funds, ask your processor for a cash advance. The rates might hurt, but at least you’re not risking your merchant account.)

I just want to end this email with an important note: If your merchant account was shut down by a card brand or processor and you were NOT doing anything wrong, please reach out to us. We can help.

Happy Tuesday & Happy Selling!

Kevin